Real estate market data holds immense value for both business strategists and investors, providing valuable perspectives on trends, pricing, and consumer actions. Utilizing this data effectively empowers businesses to make well-informed choices that resonate with market shifts. Delving into historical and present data aids in precise forecasting, enabling the identification of lucrative investment prospects. Mastering the analysis and comprehension of this extensive dataset equips businesses for triumph in a fiercely competitive environment. Leveraging real estate market data enables organizations to create strong business strategies by discovering underdeveloped markets and predicting regional growth patterns.

Understanding the Basics of Real Estate Market Data

includes an extensive collection of figures and details that are essential for making knowledgeable choices in property deals. Professionals analyze trends in:

- Housing prices: Tracking median and average sales prices offers insights into the market’s health.

- Inventory levels: The amount of available property indicates supply and demand dynamics.

- Days on market (DOM): Measures how long listings stay active, hinting at market velocity.

- Rent rates: For income properties, prevailing rent prices gauge potential returns.

- Demographic shifts: Population changes can forecast long-term demand patterns.

- Economic indicators: Employment rates and economic growth inform market stability and future prospects.

Such data instruments guide investors, realtors, and developers in making strategic choices with confidence.

Key Sources for Real Estate Market Data Acquisition

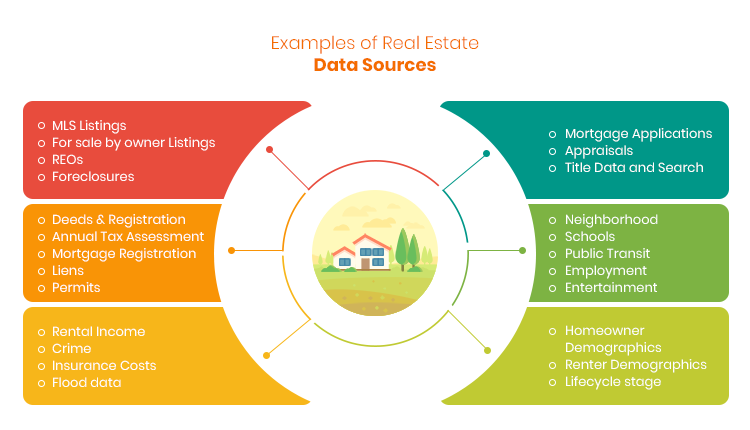

To gain comprehensive insights into the real estate market, businesses must tap into various data sources:

Image Source: https://propmix.io/improve-the-quality-of-your-real-estate-data-part1

- Multiple Listing Services (MLS): These databases provide detailed information on property listings and transactions, maintained by local real estate associations.

- Public Records: County assessor offices, recording documents, and tax records offer data on ownership, property values, and historical sales.

- Real Estate Websites: Platforms like Zillow and Redfin regularly update real estate market trends, pricing, and property features.

- Government Reports: Agencies such as the U.S. Census Bureau and the Department of Housing and Urban Development release housing market statistics and studies.

- Private Data Providers: Companies like CoreLogic and RealtyTrac specialize in aggregating and analyzing real estate data for industry professionals.

- Industry Publications: Trade journals and real estate reports often provide market analysis, expert insights, and forecasts.

Identifying Opportunities with Comparative Market Analysis

Comparative Market Analysis (CMA) serves as an indispensable tool for real estate professionals. It involves evaluating similar properties in a specific area to assess market trends and property values. By engaging in CMA, businesses can:

- Detect underpriced properties ripe for acquisition.

- Identify overvalued listings, providing a platform for negotiation.

- Recognize regional pricing trends, guiding investment strategy.

- Uncover supply and demand patterns to inform marketing tactics.

- Gauge the potential for rental income based on comparative rents.

Leveraging CMA effectively enables real estate businesses to make data-driven decisions, enhancing profitability and market positioning.

Integrating Web Scraping for Real Estate Data Management and Analysis

The incorporation of web scraping real estate data management enhances the gathering and sifting through vast data pools. Outsourced or in-house, web scraping can systematically collect property listings, price trends, and market dynamics from various online platforms. Real estate businesses can utilize this information to:

- Identify emerging market trends

- Determine competitive pricing strategies

- Analyze neighborhood demographics and economic indicators

Structured data is then fed into analysis tools for predictive modeling and investment decision-making. Implementing web scraping requires adherence to legal and ethical standards, ensuring data accuracy and reliability. This approach can afford real estate professionals a decisive edge in a data-driven marketplace.

Using Data to Enhance Marketing and Client Engagement

Leveraging real estate market data can markedly improve marketing efforts and deepen client connections. By analyzing demographic trends, purchase behaviors, and economic indicators, real estate professionals can craft targeted, relevant campaigns. Brokers harness such insights to identify:

- High-opportunity neighborhoods for different buyer profiles

- Trends in property features that appeal to current market segments

- Suitable times for market entry and property listings

Personalized engagement strategies derived from client’s activity data, such as their interaction with online listings, enhance client experience and satisfaction. Companies that adeptly use data to inform their communication foster stronger relationships, leading to increased referrals and repeat business.

Developing a Data-Driven Approach to Pricing and Valuation

Real estate businesses must embrace a data-driven strategy for accurate property pricing and valuation. This approach involves:

- Data Collection: Continuously gather data from various sources, including market trends, historical transactions, and economic indicators.

- Analytical Tools: Implement advanced analytical tools to process and analyze the data efficiently.

- Pricing Models: Develop sophisticated pricing models that utilize machine learning and statistical analysis to predict property values.

- Market Comparison: Regularly compare predicted prices with the actual market to refine algorithms and models.

- Expert Interpretation: Employ experienced analysts to interpret data insights and incorporate local market knowledge.

- Continuous Improvement: Continuously update data sets and models to adapt to changing market conditions, ensuring accuracy in pricing and valuation.

Incorporating these steps ensures that real estate businesses maintain competitive edge through informed decision-making in pricing and valuation.

Transforming Real Estate Market Data into a Competitive Edge

In the landscape of property transactions, harnessing real estate market data effectively means turning raw numbers into actionable insights. Successful businesses analyze trends, identify growth opportunities, and anticipate shifts that impact investments. By integrating technology, such as AI analytics, professionals can forecast with greater accuracy.

Tailored marketing strategies emerge from demographic analytics, enabling targeted and efficient client engagement. Diligent data application creates an environment of informed decision-making, setting industry leaders apart. Firms that deftly convert data into strategy secure a formidable competitive edge in an ever-evolving real estate market.