Every aspect of business is changing, including how we assess property value. In the past, property valuation required local knowledge and intuition based on historical sales, but technology, such as AI-powered real estate data analytics, makes the valuation process more accurate, efficient, and scalable.

New technology powered by real estate data APIs allows real-time aggregation and processing of vast amounts of data. This change accompanies growing demand for PropTech solutions, enabling better decision-making for real estate analysts, valuation firms, and PropTech startups.

In this article, we will discuss the role of data aggregation technologies in AI in transforming valuation processes and outcomes to showcase the future of the industry.

Why Property Valuation Needs AI-Powered Data Aggregation

Image Source: AITGlobalInc

Buyers, sellers, lenders, and investors require accurate property valuation, but gathering data is still a challenge. In previous decades, collecting data was done manually via public data records, real estate MLSs, and market reports. All these methodologies had flaws, including:

- Time-Consuming: Apart from the lack of valuation accuracy, the process is too slow for individual property evaluations.

- Data Gaps: Properties with missing or outdated real estate data tend to receive inaccurate estimates.

- Subjectivity: Certain properties may receive different valuations depending on the appraiser, increasing bias.

These challenges are being addressed with the help of AI in the real estate industry. AI can aggregate large real estate data sets, identify trends, and provide objective and data-backed valuations.

This is very critical in the U.S. real estate data market considering how property prices undergo economic shifts due to interest rates, supply and demand, and economic changes.

How AI Aggregates and Analyzes Real Estate Data

The process for AI-driven real estate data analytics begins with the collection of information from various sources which needs to be cleaned and processed in order to produce insights. Below are the steps involved:

1. Data Collection from Multiple Sources

Image Source: PropMix

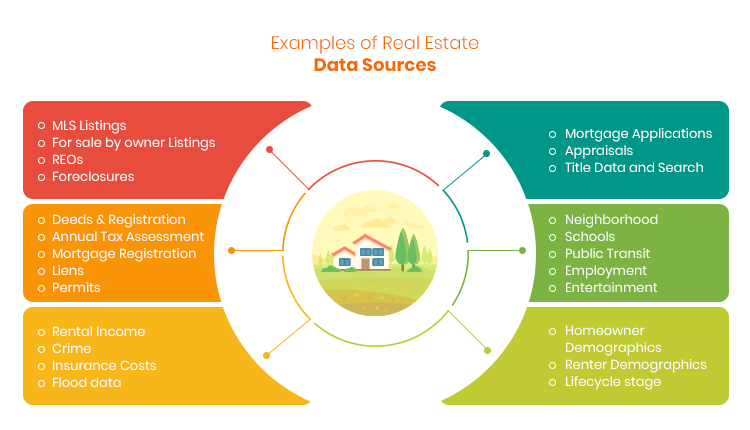

AI-powered systems aggregate real estate data from:

- Property listings (MLS, real estate portals)

- Public records (tax assessments, ownership history)

- Mortgage and foreclosure data

- Economic indicators (interest rates, employment rates)

- Social and environmental factors (crime rates, school districts, walkability scores)

This level of data gathering allows accessing real-time information for real estate professionals all in one place rather than dealing with disintegrated sources.

2. Data Cleaning and Standardization

AI-powered real estate data APIs need to standardize and clean data to ensure accuracy as raw data often contains inconsistencies. This part is very important because property valuations can rely on outdated or incorrect data which can be harmful.

3. Predictive Analytics for Accurate Valuation

Analyzing past sales, and neighborhood growth, and even forecasting market changes creates valuable opportunities. AI performs the following functions:

- Comparative Market Analysis (CMA): AI makes it possible to compare properties automatically based on size, location, and other specifics.

- Price Trend Forecasting: AI is capable of estimating property prices as long as there is sufficient historical data and favorable market conditions.

- Automated Valuation Models (AVMs): AVMs, as the name suggests, provide instant valuation services and precision.

An Urban Institute study showed that AI-assisted models bring roughly 15% fewer discrepancies compared to traditional models due to their accuracy (Urban Institute).

The Role of Real Estate Data APIs in AI-Driven Valuation

There has been a noticeable improvement in algorithm-aided estimation of properties with the introduction of real estate data APIs. The APIs give users access to real-time data enabling seamless integration into their systems.

Benefits of Real Estate Data APIs:

- Real-Time Data Access: APIs fetch data from a number of platforms, allowing real-time integration into Valuation models.

- Automation & Scalability: Gathering data can be a tiresome process but APIs help to streamline the whole process.

- Better Decision-Making: AI provides accurate information that enables better property risk analysis by investors and lenders.

A prime example is the use of property data APIs by Zillow and Redfin powered with AI to provide customers with instant property valuations. This enhances transparency as it helps customers understand the entire home-buying procedure.

How AI is Enhancing Real Estate Market Transparency

Previously, there was a gap in the real estate data available to the public and what was accessible only to industry insiders such as brokers, appraisers, and large real estate firms, but AI-driven real estate data analytics is changing that.

1. More Informed Buyers and Sellers

With buyers and sellers having easy access to the internet, AI-powered valuation models are assisting in providing sellers and buyers with data-driven insights. A report by the National Association of Realtors showed that 97% of homebuyers had searched for available properties online in 2023 (NAR Report).

This indicates a growing acceptance of tools and AI-powered pricing models.

2. Reduced Bias in Property Valuation

AI models rely on real estate data, unlike traditional models that were subject to human bias. This adds value as appraisals are less likely to face issues of overvaluation or undervaluation.

3. Investment Opportunities in Undervalued Markets

Through pattern analysis of population growth, new infrastructure, and employment opportunities, among others, AI has the capability of uncovering emerging markets. This gives investors the chance to purchase properties thought to be undervalued before the price goes up.

How PromptCloud Helps with Real Estate Data Aggregation

PromptCloud has a proprietary technology that enables the gathering of high-quality real estate data for efficient property valuation.

1. Web Scraping for Real Estate Data

PromptCloud allows real estate businesses to effortlessly scrape real estate data from numerous sources, such as:

- Real estate listing websites like Zillow, Realtor.com, and Redfin

- Property auction sites and foreclosure databases

- County assessor websites for tax and ownership records

- Rental platforms like Airbnb and Zillow Rentals

Leveraging web scraping, PromptCloud delivers granular and up-to-the-minute information regarding U.S. real estate markets, which can be applied for AI analysis and computation.

2. Data Customization and API Integration

Businesses require collecting different types of real estate data responsive to their activities. PromptCloud provides the following:

- Custom Data Extraction: Specific data fields such as price trend analytics and neighborhood mortgage evaluations are available.

- Real-Time Data APIs: Integrate APIs to obtain constant feeds of real estate data in your system.

3. Scalable and Automated Data Processing

The collection and updating of datasets previously done manually has been made easier with PromptCloud’s automation tools, allowing for:

- Timely Market Insights: Access up-to-date property valuations and trends.

- Elimination of Data Gaps: Reduce inaccuracies caused by missing or outdated information.

With AI-enabled real estate data aggregation, valuation firms, PropTech startups, and investors are empowered to make confident data-driven decisions with the assistance of PromptCloud.

Challenges and Future of AI-Powered Property Valuation

AI-powered real estate data aggregation has its challenges just like any other service has its pros and cons.

- Data Privacy & Security: The sheer volume of real estate data in the US makes the need for extremely secure methods of data protection against breaches imperative.

- Algorithm Transparency: There should be AI-enabled models that don’t discriminate in identifying the value of a property, particularly in lending mortgages, because there should be equality in the use of algorithms.

- Market Volatility: AI technology can aid in predicting trends, however, drastic changes in the economy (like heading into recession) will impact valuations for no understandable reason.

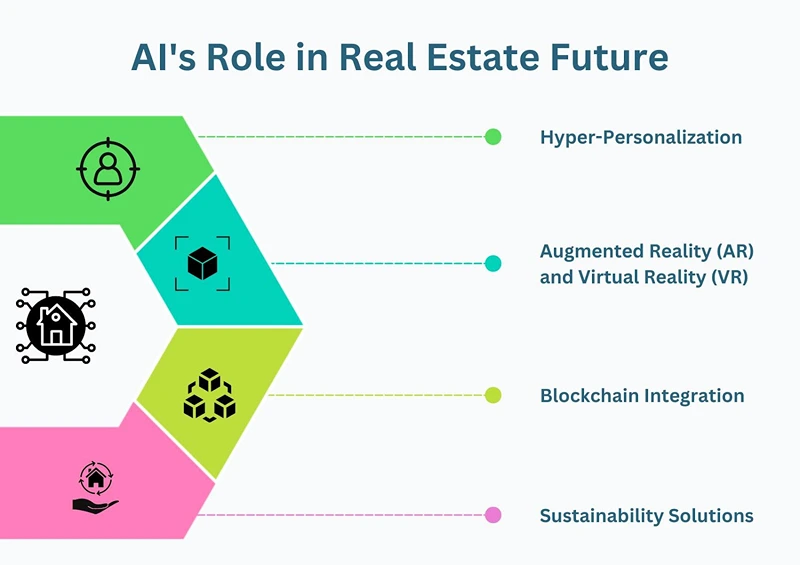

Looking ahead, AI in real estate data analytics will continue to evolve. Better machine learning algorithms paired with richer datasets will make property valuation much more effortless for all stakeholders so decisions can be made with no second thoughts.

Final Thoughts

The automation of real estate data aggregation is changing the game for property valuation. It helps make the process efficient, transparent, and most importantly accurate. PropTech companies, valuation service providers, and even analysts can utilize these real estate data APIs and get real-time insights on the market to help them make strategic decisions.As AI technology advances, property valuation will no longer be a guessing game. Instead, it will be a data-driven process, ensuring fair pricing for buyers, sellers, and investors alike. If you are in the real estate business, AI-driven real estate analytics tools will help you stay ahead of the competition. Contact us today!