It’s 7 p.m. on a Sunday, and a shopper is browsing online for a last-minute birthday gift. They find the perfect item on Walmart’s site, but it’s out of stock. Without hesitating, they switch tabs and buy the same product from a smaller retailer that had it available for next-day delivery. For that smaller retailer, this wasn’t luck, it was strategy.

Moments like this show why Walmart product availability is such a powerful indicator for retailers. Walmart doesn’t just sell products. It shapes customer expectations across the entire market. If a popular item is unavailable at Walmart, shoppers will look elsewhere, and fast. For competing retailers, knowing when these gaps happen can open up real opportunities to capture sales and gain visibility.

Tracking Walmart stock isn’t about copying what Walmart does. It’s about using data to understand what’s selling, what’s running low, and what customers are searching for. Retailers who pay attention to Walmart’s inventory trends can react faster, restock smarter, and stay ahead of shifts in demand before they affect their bottom line.

Image Source: Browserless

How Real-Time Walmart Stock Data Supports Smarter Inventory Decisions

Retailers don’t have the luxury of waiting around anymore. When Walmart runs out of a product, the clock starts ticking. Customers start searching elsewhere, and whoever has that product available, at the right price and with fast delivery, wins the sale. That’s where real-time data on Walmart product availability becomes a competitive weapon.

By tracking Walmart stock in real time, retailers can see which items are available, which are running low, and which have disappeared from digital shelves altogether. That information isn’t just interesting, it’s actionable. It allows businesses to adjust their own inventory plans, identify demand gaps, and step in where Walmart can’t immediately deliver.

Let’s say Walmart’s stock of a trending home appliance starts to drop. A smart retailer, watching that data closely, can quickly raise visibility on their own listings, adjust pricing if needed, and even increase ad spend for that product. The goal is simple: be present and ready when demand shifts.

It also works the other way. If Walmart keeps a product well-stocked over time, that’s a clear indicator of consistent demand. Retailers can use this insight to make smarter decisions on what to stock and how much of it to carry, minimizing waste, storage costs, and markdowns later.

Ultimately, real-time insights into Walmart product availability give retailers the clarity to act, not react. And in today’s market, that difference can be the line between growing and falling behind.

How Walmart’s Stock Strategy Shapes the Retail Landscape

Image Source: Slideteam

Walmart doesn’t just sell a lot of products, it moves markets. When a company this size shifts how it stocks, prices or promotes a product, it often forces everyone else to adjust. That’s why understanding how Walmart manages its stock isn’t just useful, it’s strategic.

One thing Walmart does well is avoid sitting on slow-moving inventory. If something isn’t selling, it gets marked down or removed fast. On the flip side, when a product picks up momentum, Walmart doubles down, more units, more visibility, faster delivery. This constant balancing act keeps their supply chain lean and their shelves relevant.

But here’s the part that matters for other retailers: Walmart’s inventory changes don’t happen in isolation. When they stock up on a certain item, it usually means they’re expecting a spike in demand. If they start pulling back, that could signal softening interest or even supply chain trouble. Watching these changes gives competitors early warning signs and a chance to react.

Let’s say Walmart starts running low on a certain home appliance in early November. That’s probably not random. It could be a sign of early holiday demand. If you’re a retailer watching that in real time, you can manage your stock, tweak your promotions, or plan for a potential lift in traffic. And if you’re not watching? You’re behind.

Walmart’s stock decisions affect more than just their own stores. They shape customer expectations on price, availability, and timing, and every retailer in their space ends up playing catch-up unless they’re tracking these signals early.

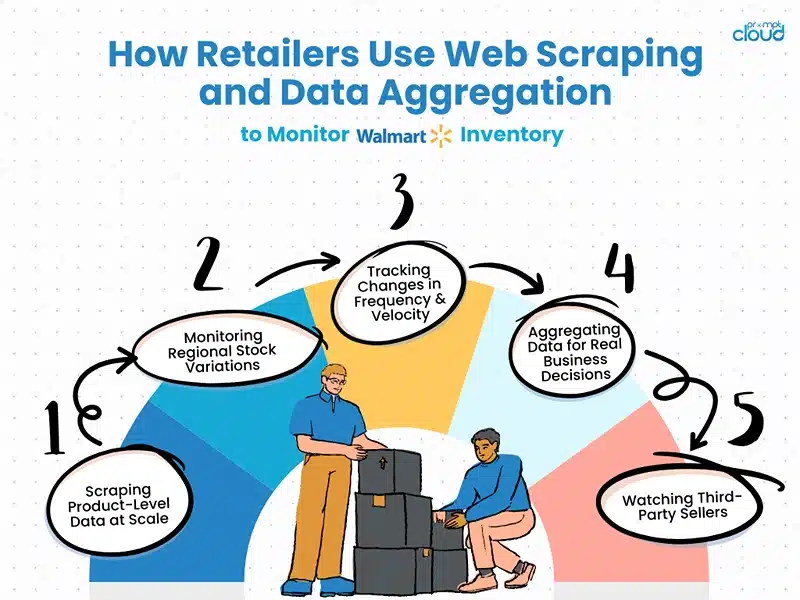

How Retailers Use Web Scraping and Data Aggregation to Monitor Walmart’s Inventory

Understanding Walmart product availability across thousands of SKUs and locations isn’t something you can do manually. That’s why most retailers rely on web scraping and data aggregation to get a clear picture of what’s happening and act on it.

Here’s how that works in practice:

1. Scraping Product-Level Data at Scale

Retailers use automated tools to extract structured data directly from Walmart’s site. This includes stock status, price, location availability, shipping times, and more across entire categories. The goal isn’t just to track one product, but to understand Walmart’s inventory behavior as a whole.

2. Monitoring Regional Stock Variations

Walmart’s inventory doesn’t move the same way everywhere. Scraping data by zip code or store region helps identify where stock is dropping or shifting. This kind of geographic insight allows you to move your own inventory to the right locations before demand hits.

3. Tracking Changes in Frequency and Velocity

By monitoring how often Walmart updates stock status for specific products, retailers can identify fast movers, seasonal spikes, or even potential supply chain constraints. Seeing these trends as they develop gives you a head start on planning.

4. Aggregating Data for Real Business Decisions

Scraped data on its own isn’t useful unless it’s cleaned and combined with your internal systems. Retailers typically feed this data into dashboards, analytics tools, or AI models to inform everything from restocking to pricing decisions.

5. Watching Third-Party Sellers on Walmart Marketplace

It’s not just Walmart’s own inventory that matters. Retailers also scrape Walmart’s third-party marketplace to watch for undercutting sellers, stock availability from competitors, and how listings are being positioned. That insight helps shape how you list and price your own products.

Using this layered approach, scrape, monitor, aggregate, and act, gives retailers a clear, real-time view of Walmart stock. And that visibility is what turns data into actual decisions.

Using AI and Predictive Analytics to Stay Ahead of Stockouts

Running out of stock doesn’t just mean missing a sale, it means letting your customer down. And in a market where loyalty is fragile and competitors are a click away, most retailers can’t afford that. That’s why predictive analytics, powered by AI, is becoming a key part of how companies manage inventory, especially when they’re tracking Walmart product availability for signals.

At its core, predictive analytics is about looking at patterns, past sales, seasonal spikes, regional demand, supplier lead times, and using those patterns to forecast what’s likely to happen next. Combine that with real-time Walmart stock data, and you get a much clearer view of how demand might shift and where potential stockouts could happen.

Here’s an example. Let’s say you’re seeing Walmart run low on mid-range air purifiers across several regions. Your own data shows an uptick in interest in those products during spring. An AI model that’s trained on past demand trends, weather patterns, and shipping timelines can help you figure out if that’s just a local blip or the start of a seasonal surge. And if it’s the latter, you’ve got time to move. You can reorder early, push promotions, or shift stock from lower-demand areas before shelves go empty.

This kind of forecasting isn’t about trying to guess the future, it’s about stacking the odds in your favor using every signal available. Walmart’s own stocking behavior gives you one set of signals. Your internal data gives you another. Predictive models pull those pieces together and help you make smarter calls before it’s too late.

The best part? AI doesn’t sleep. These models can run 24/7, constantly analyzing shifts in Walmart stock, online pricing, and your own inventory flow. That means you’re not waiting for someone on your team to spot a trend; your system is already flagging it, days ahead of when it used to be possible.

The result is fewer stockouts, more sales captured, and a more stable supply chain.

Why Monitoring Walmart Product Availability Isn’t Optional Anymore

Retail has always been competitive, but the pace today is relentless. Products go in and out of stock in hours, not weeks. Prices shift daily. Customer expectations are higher than ever. And through all of this, Walmart continues to move faster, smarter, and at a massive scale. For retailers trying to compete, that means watching what Walmart does isn’t just smart, it’s necessary.

Tracking Walmart product availability gives you more than just a peek at what’s on their digital shelves. It gives you signals early on about how demand is changing, what’s about to trend, and where gaps in the market are starting to open up. It helps you avoid overstocking the wrong items and missing out on the ones that are actually selling.

But more than anything, it helps you stay proactive. When you’re using real-time data, web scraping tools, AI, and predictive analytics together, you stop reacting to the market and start moving with it. You’re not waiting for sales to drop before you change something; you’re making decisions while you still have the room to adjust.

This is the new standard. Category managers, supply chain analysts, pricing teams, everyone across the retail organization benefits when there’s clear visibility into what Walmart is doing with its inventory. The smarter your data, the sharper your decisions, and the faster your response time.

Walmart will keep setting the pace. The question is whether you’re watching closely enough to keep up, or better yet, stay one step ahead.

How PromptCloud Helps Retailers Track Walmart Product Availability at Scale

Keeping up with Walmart’s constantly changing stock landscape takes more than internal tools and manual tracking. You need clean, structured, real-time data, and that’s exactly where PromptCloud steps in.

Here’s how PromptCloud supports retailers, analysts, and e-commerce teams who want to stay ahead of the game:

1. Scalable Web Scraping Across Walmart’s Platform

We extract structured data across thousands of Walmart product listings, categories, and zip codes, including availability status, price, seller type, and shipping options. Whether you’re tracking a handful of SKUs or the entire marketplace, we scale with your needs.

2. Real-Time and Custom Data Feeds

Need hourly updates? Daily snapshots? Region-specific availability? We tailor data feeds to your exact requirements, ensuring you always have the latest stock movement at your fingertips.

3. Clean, Ready-to-Use Data

We don’t just scrape data, we deliver it in a format your systems can actually use. Whether it’s CSV, JSON, or API-based delivery, your teams get clean, reliable Walmart stock data without the noise.

4. Dedicated Support and Custom Workflows

Every retail use case is different. Our team works with you directly to build workflows and dashboards that match your internal goals, whether that’s pricing analysis, category planning, or stock forecasting.

5. Compliance-Focused, Enterprise-Ready Infrastructure

We prioritize ethical data practices and compliance at scale. Our infrastructure is built to handle high-volume, enterprise-grade operations with reliability and transparency.

You don’t need to guess what Walmart will do next. With the right data partner, you can see it in real time and act before the market shifts.Reach out to us today and let’s talk about how we can help you track Walmart product availability and turn that insight into real results.