By big data and analytics

Big risks require big data thinking. Financial, operational, compliance, and enterprise are all high risk domains where big data application offers solutions not just in mitigation but also striking the perfect balance between risk taking and commercial gain.

Analytics and computations add dimensions to risk management by providing the tools and capability to identify and analyze potential effects of large-scale, high-impact incidents.

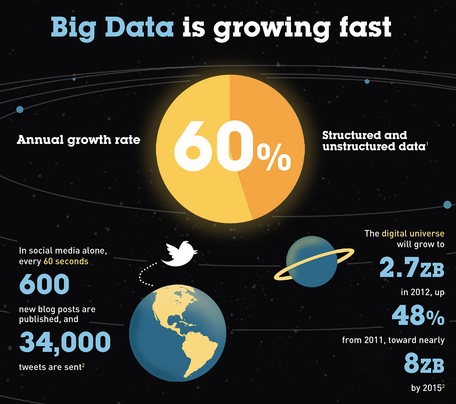

Big Data Revelation

Visibly, predictive models based on big data analytics are the main go-to when it comes to setting up risk management programs. An integrated approach to manage operational risk is particularly important. Special enterprise risk information systems play an important role in this. These optimize big data analysis, and

The essence of risk intelligence lies in understanding the exposure. In today’s highly competitive and volatile world, a single, unforeseen event can leave businesses crippled. This is true especially for insurance companies who deal with claims worth hundreds of millions on a regular basis and where risks covered are highly vulnerable to external factors.

Enterprise performance is affected by external forces viz. market factors, technological gaps, talent-skill shortages, socio-economic upheavals, environmental issues and geopolitical factors. These dynamics are constantly changing and hence, the risk exposure is just too great. It impacts not just enterprises but also customer demand, operations, brand, and market stability. Ominously, risk never really decreases.

The key lies in using analytics to gather intelligence to minimize risk exposure. Reactive measures are not enough, and the need to manage risk requires proactive action.

Configuring risk

Aligning risk management to business goals and strategies is crucial. Strategic objectives must be cross-examined with effects of risk factors on them. Broadening risk awareness only helps in monitoring risk tolerance and predicting how risk-related events can be remediated or recovered. The progression ideally should be thus: broadening risk awareness that leads to intelligence improvement, eventually resulting in the reduction of risk impact.

Although risk management is now being adopted vigorously and religiously, the critical mass needed to eventually use it takes time to build. Barriers like lack of vision, failure to adopt best practices, reluctance in use of emerging technology, and even commitment to policy affect the way analytics can be used in risk management.

And yet, the single largest reason to emerge is budget. Budget limitations and predicting the return on investment (RoI) habitually plagues all risk management programs and solutions. To turn this around, business use-cases of risk management help greatly. These cases demonstrate the economics of RoI, cost efficiencies, and the competitive advantage born out of a risk management program.

Image credits: moneyinbusiness.com | laveti-infosec.blogspot