The travel industry has always been data-driven, but in 2025, that reliance has intensified to unprecedented levels. From dynamic pricing strategies to personalized trip planning, brands in the tourism sector need comprehensive, high-quality information to remain competitive. As more consumers turn to online platforms for flights, accommodations, and local experiences, the availability of structured intelligence has expanded in scope and complexity. For those with the tools to collect and interpret it, there’s a distinct edge in both day-to-day operations and long-term strategic growth.

Underneath the glossy brochures and alluring social media posts, leading travel brands are busy tapping into a steady flow of data from a variety of online sources. This includes aggregators, price comparison sites, government tourism boards, and more. When combined, this wealth of online information can form a powerful travel dataset that drives everything from real-time demand forecasting to hyper-personalized recommendations. But how exactly do these organizations acquire the insights needed to shape user experiences, optimize marketing campaigns, and outmaneuver competitors? The answer often lies in automated web scraping – a method that systematically collects publicly available online data.

Below, we’ll dive into the top sources that major travel brands scrape, why these channels matter, and how businesses turn unstructured information into strategic gold. Along the way, we’ll see how a robust travel dataset can spark data-driven decision-making, support operational efficiency, and adapt to changing travel trends.

What Does a Data-First Landscape Mean for Travel Brands?

Before we explore specific data sources, it’s crucial to understand why travel brands have evolved toward a data-first mindset. Consumer expectations for immediate, customized results have never been higher. People now want tailored itineraries that align with their budgets, preferred activities, and even dietary restrictions—all served up instantly. Meanwhile, competition has exploded, with countless online travel agencies (OTAs), booking platforms, and specialized apps vying for user attention.

In this environment, a robust travel dataset is the key to standing out. When your marketing team understands where tourists want to go next quarter, or your product team knows which amenities matter most to millennial travelers, strategies become proactive rather than reactive. Gone are the days of educated guesses and approximations. Leading companies gather detailed information at scale – flights, hotel prices, user reviews, local events – and feed it into advanced analytics platforms to uncover actionable insights.

1. Online Travel Agency Platforms

Source: LinkedIn Pulse

OTA websites – think Booking.com, Expedia, and Agoda – host enormous volumes of listings for accommodations, flights, and attractions across the globe. Scraping these websites provides brands with a near-comprehensive overview of pricing fluctuations, room availability, customer reviews, and promotional activities. Insights gleaned from an OTA-focused travel dataset enable airlines to tweak routes or timing, hoteliers to competitively price their rooms, and third-party platforms to identify where demand is trending.

Yet, extracting data from OTAs can be technically complex. Since these sites are frequently updated and heavily trafficked, companies must manage significant scale when collecting listings. Additionally, OTAs continuously refine their page structures to improve user experiences, so any scraping approach must adapt quickly to layout changes. Still, the payoff is immense, as OTA data reveals real-time shifts in travel patterns, especially beneficial when consumer sentiment can swing in response to geopolitical events, weather disruptions, or emerging travel trends.

2. Airline and Hotel Brand Websites

Beyond OTAs, major travel brands also turn to direct airline and hotel websites. Why? Because these official channels often showcase unique promotions not visible on aggregator sites. They may also share real-time inventory details, loyalty program offers, and seasonal discounts. For a competitor or a market analyst, tapping into this structured and unstructured data can lead to a richer travel dataset for price benchmarking and strategic positioning.

For instance, if an airline wants to gauge how a rival adjusts prices three days before departure, it can scrape the competitor’s site to track ticket changes at specific intervals. Similarly, hotels can gather data on property photos, amenity lists, and user ratings from both competitor brand sites and their own official channels to monitor brand perception. The result is a 360-degree view of how each entity in the market sets prices and advertises features, helping them stay a step ahead in a crowded playing field.

3. Global Distribution Systems (GDS) and Metasearch Platforms

While OTAs might be the household names for travelers, it’s often metasearch engines (like Skyscanner or Kayak) and GDS networks that power the real-time inventory displayed in countless booking portals. Metasearch platforms consolidate flight schedules, hotel listings, and car rental availability from multiple sources, giving users side-by-side price comparisons. When brands integrate data from these metasearch platforms, they assemble a travel dataset capable of revealing cross-platform pricing anomalies and spotting short-lived promotions.

This aggregated view is crucial for dynamic pricing algorithms, which rely on real-time data to adjust offerings. Imagine a scenario where a city is hosting a major convention: hotels fill up, flights get pricier, and travelers scramble for deals. Metasearch data shows the speed and magnitude of the spike, enabling quick moves for those who rely on automated processes to sense demand shifts. Once the event ends, historical data from metasearch platforms can also help refine future pricing models, so you’re better prepared for the next large-scale occasion.

4. Review Aggregators and Social Platforms

In the modern travel industry, customer reviews are king. People base accommodation choices not only on price and location but also on first-hand user experiences. Consequently, leading brands frequently scrape TripAdvisor, Yelp, and even Google Maps for customer feedback and star ratings. Social media sites, too, can form a critical part of a well-rounded travel dataset. Twitter, Instagram, and Facebook often unveil hidden gems – such as trending local hotspots or newly opened boutique hotels—before these have official coverage on traditional booking platforms.

Structured data from review aggregators reveals patterns in user sentiment, frequent complaints, and potential areas for improvement. A property consistently praised for cleanliness but criticized for outdated decor has clear marching orders. Airlines or tourism boards that analyze social chatter can gauge real-time traveler sentiment about destinations and flight experiences, adjusting their marketing or operational strategy on the fly. When you have this kind of feedback loop, you can refine your approach to better fit what travelers actually want.

5. Government Tourism Sites and Public Databases

Public sources are also incredibly valuable for constructing a comprehensive travel dataset. Official tourism boards publish statistics on visitor volumes, popular landmarks, and local events. Immigration authorities may release up-to-date guidelines, visa policies, and travel advisories. Combining these public datasets with real-time web-scraped content helps businesses project demand levels and tailor offerings to specific regions.

A big advantage here is the credibility and accuracy of government or municipal data. For instance, a local tourist board’s announcement about a forthcoming festival could drastically alter regional demand. If a travel brand or airline picks up on that early enough—perhaps by scraping an official press release – they can deploy timely marketing campaigns or readjust flight capacities to capture emerging demand.

6. Local Platforms and Blogs

It’s easy to focus on established channels, but smaller regional sites or niche travel blogs can provide a nuanced view of what’s trending on the ground. For example, in certain developing markets, local portals might be the go-to resource for vacation rentals, guided tours, or unique home-stay experiences. Similarly, influential travel bloggers often update curated lists of recommended eateries or cultural experiences that are absent from mainstream aggregators.

Scraping these specialized sources can yield a travel dataset that sets your brand apart, highlighting hidden gems or niche offerings. A boutique travel agency might discover an up-and-coming region for ecotourism. An airline could spot a rising demand corridor between two overlooked destinations. Acting on these insights sooner than competitors fosters a stronger brand image as an innovator in travel – someone who uncovers experiences beyond the standard tourist traps.

How Travel Brands Convert Raw Data into Winning Strategies?

Pulling data from all these sources is only the beginning. The transformation from raw web content to structured intelligence requires a reliable pipeline:

- Extraction & Cleaning: Automated web scraping tools gather large volumes of data, then standardize the results to remove duplications or inconsistencies.

- Integration & Storage: Structured results are housed in a data lake or warehouse, where they can be easily accessed by various teams – marketing, analytics, product, or revenue management.

- Analytics & Visualization: Data scientists and BI teams overlay advanced analytics to spot trends, anomalies, and correlations that might not be obvious at first glance.

- Real-Time Updates: Leading travel brands rely on data feeds that refresh multiple times per day, allowing for prompt responses to changes in consumer behavior or competitor adjustments.

The beauty of a well-maintained travel dataset is that it underpins a cycle of continuous improvement. As models learn from new data, recommendations get smarter, personalization becomes more accurate, and marketing becomes more targeted. Whether you’re a global airline or a niche operator, these insights inform critical decisions – like expanding routes or investing in new product lines.

Simplifying Large-Scale Web Scraping with Proven Solutions

Source: scrapehero

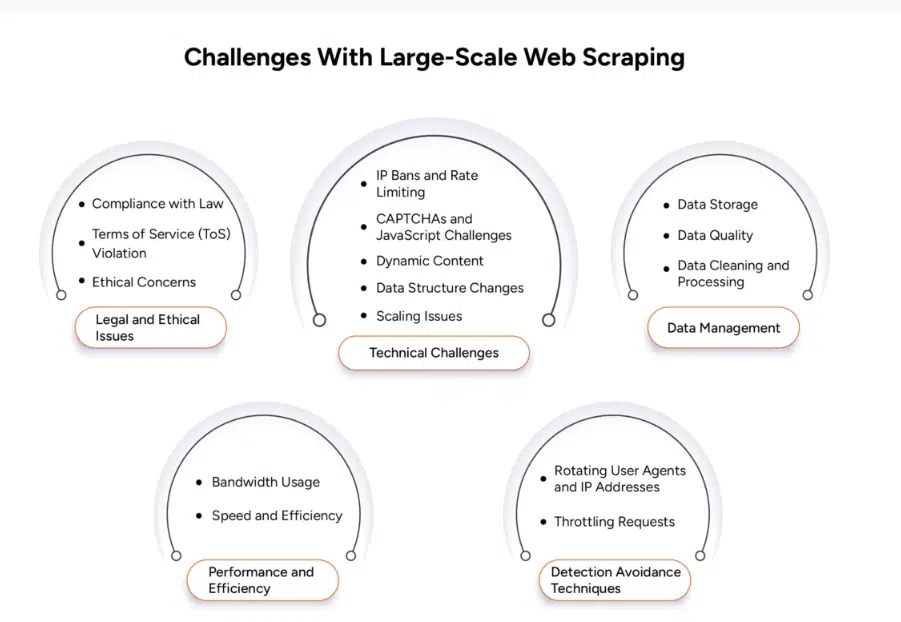

While the payoff is enormous, gathering data from multiple travel sites at scale does come with challenges. Website structures can shift, anti-bot measures can tighten, and the sheer volume of data can strain in-house systems. A robust approach to web scraping involves:

- Adaptive Solutions: Tools that detect and adapt to changes in page layouts automatically.

- Compliance and Responsibility: Following best practices to respect website terms of service, robots.txt directives, and local regulations.

- Quality Checks: Ensuring that the final travel dataset remains clean, consistently formatted, and error-free.

- Security & Infrastructure: Hosting solutions that can handle spikes in data requests, as well as employing proxy management to avoid IP blocking.

Brands that prefer a more hands-off approach often partner with specialized data extraction providers. These providers handle the technical intricacies and deliver data in user-friendly formats, freeing internal teams to focus on analysis and strategy.

The Future of Travel Data in 2025 and Beyond

The next wave of innovation in the travel industry will likely revolve around personalization at scale. As AI-driven recommendation engines become more common, the importance of having a nuanced, all-encompassing travel dataset grows ever larger. People increasingly rely on voice assistants, chatbots, and app notifications for travel planning, expecting near-instant responses that are contextually aware of their personal needs.

Meanwhile, the boundaries of travel are expanding. “Work-cations,” extended stays, and immersive local experiences are growing trends. Forward-thinking brands can spot these shifts early by analyzing the data footprints left behind by enthusiastic travelers on social media or micro-blogging platforms. Pair that with fresh insights from airline price movements, local event calendars, and user reviews, and you’ve got a potent formula for creating packages that resonate deeply with new consumer behaviors.

Conclusion

Scraping public online data has become a cornerstone of strategy for leading travel brands. Whether it’s gleaning flight pricing insights from OTAs, capturing user sentiment via social media, or harnessing local intelligence from niche sites, all of these sources can feed into one cohesive travel dataset—the foundation for informed decision-making, agile pricing, and spot-on customer experiences.

At the heart of this movement is the conviction that data shapes the future of the travel industry. While competition intensifies and traveler preferences grow more complex, those equipped with thorough, real-time data hold a significant advantage. A brand that can pivot quickly, adapt to unexpected demand, and offer novel destinations stands out in a crowded market.

If you’re ready to take advantage of sophisticated data extraction, consider how a flexible scraping framework can supply you with a rich travel dataset – from flight schedules and hotel rates to in-depth traveler reviews and emerging local trends. With the right expertise and technology in place, these scattered data points become a cohesive guide, enabling you to deliver travel experiences that not only meet expectations but consistently surpass them.

Building an extensive, up-to-date travel dataset doesn’t have to be a cumbersome, in-house task. By leveraging specialized web scraping solutions, you can gain continuous access to the digital pulse of the global travel market. As consumer behaviors keep evolving, and as new players emerge, the ability to pivot strategically will set successful travel brands apart.Whether you’re a multinational chain seeking new regions for expansion or a niche platform aiming for hyper-personalized packages, comprehensive data is the secret ingredient for delivering value. And in 2025, value is defined by speed, relevance, and reliability – attributes you can only achieve when you’re guided by a real-time view of the travel universe. For travel data scraping, get in touch with us at sales@promptcloud.com